This is not investment advice. Bitcoin is highly volatile. Past performance of back-tested models is no assurance of future performance. Only invest what you can afford to lose. You must decide how much of your investment capital you are willing to risk with Bitcoin. No warranties are expressed or implied.

Bitcoin is the best performing asset class during 2020, up 112% since the beginning of the year. It is also the best performing asset class for the past decade by far. This alone suggests a substantial portfolio allocation is warranted.

There are a lot of suggestions floating around for 1% or a few percent allocation to Bitcoin, as portfolio stabilization and performance enhancement to otherwise typical stock, bond, etc. portfolios. But the historical evidence suggests a much larger allocation, in double digits, is warranted.

The optimal sizing for a two-outcome bet or two component portfolio allocation can be determined by the Kelly growth criterion, which grows the expected value of the log of wealth more rapidly than other methods. We assume a portfolio with only cash and Bitcoin in some proportion.

The optimal fraction of such a portfolio toward the risky asset is f = (b*p - q)/b, where p is the expected win percentage, q the loss percentage, and b is the ratio of average win size to average loss size. For the trivial case of equal wins and losses b = 1, the optimal fraction is just p - q, so if your expected win percentage were 60% you would allocate 20% of your portfolio to a bet or a stock or to Bitcoin (because q = 40%).

Win percentage can be determined by picking a time frame of interest and looking at historical returns. Longer term, Bitcoin increases in price strongly while having high volatility; longer time frames should be more relevant.

In this article I use time intervals of Block months, since the Halvings have such a major effect on the Bitcoin price cycles. There are 12 Block months in a Block year of 52,500 blocks, and there are 4 Block years between each Halving, separated from one another by 210,000 blocks. Block years are nearly the length of calendar years but have been running faster by about two weeks.

As of today we have just passed block 656,250 and thus 12.5 Block years have elapsed since Bitcoin started, and we are half a Block year (six Block months) past the third Halving that occurred on May 11, 2020 (May 12th in Asia).

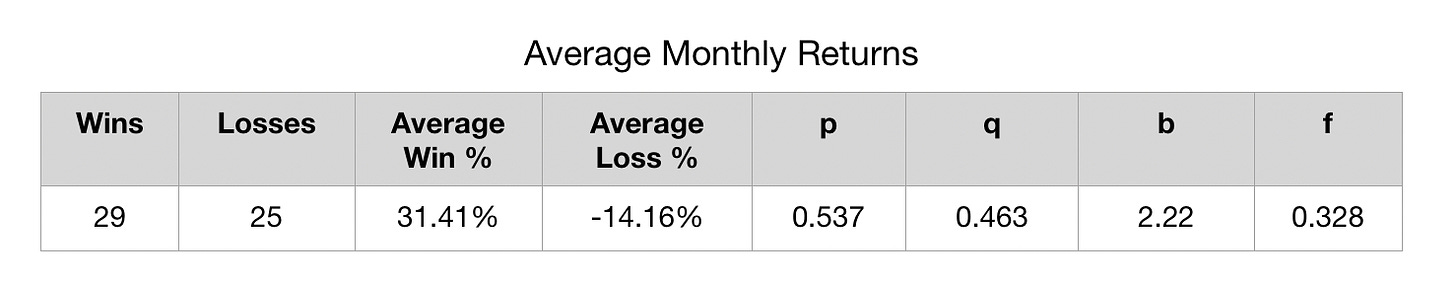

To calculate the optimal fraction of a portfolio that only contains US $ and Bitcoin, I use the past 4.5 Block years of monthly data, starting from the second Halving in July, 2016. In this case the number of wins during the 54 Block months is 29, the number of losing months is 25, and the average win is a 31.4% increase during a month. The average loss is -14.2% and the average win magnitude divided by the average loss magnitude, or b, is 2.22. So with p = 0.537, q = 0.463, and b = 2.22, our optimal Kelly fraction is 32.8%.

This suggests one should have up to 33% or just under one third of one’s portfolio allocated to Bitcoin. If we look back for 10 Block years, despite the phenomenal performance with four of those years returning over 300% each, the Kelly f value is just a few percent higher, at 36%. (During that interval we observe p = 0.57, q = 0.43, and b = 2.64).

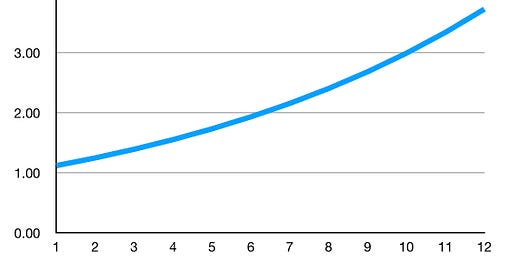

One can also use a related Kelly formula [p * ln (1+b*f) + q * ln (1-f)] to calculate the expected growth of such an allocation, and it works out to exp(0.11) per month or 11.6% per month as a longer term average, an annual price growth factor of 3.73 times. Nice compounding if you can get it. And that is for a one-third allocation to Bitcoin.

In comparison a simple Lindy power-law model with Block year age predicts growth in fair value price of 50% over the next Block year. Why the discrepancy? A Kelly criteria outperforms over long time periods because it causes you to trim holdings when Bitcoin is overbought and to buy when it is oversold, in order to maintain your portfolio percentage at the desired level. Buy low, sell high.

The intent here is that one adjusts the portfolio fraction as new price data is received, as well as rebalancing to the optimal f regularly so as not to be over- or under-invested. This is not a one year forecast but a likely mean outcome over substantial time periods. You may well need to follow the method through a full Halving cycle or longer for it to be robust.

Now the Kelly criterion is the most aggressive, fastest wealth growth posture, and exposes one to rather high risk with such a volatile asset. Although it is designed to avoid ruin in the long term, some prefer to use a fractional Kelly strategy that has less upside but smaller drawdowns. For example, in this case for the 4.5 Block years of look back, a so-called “half Kelly” allocation would be 16.4% of one’s portfolio.

This is only a start toward portfolio optimization, since one could very well also be holding stocks (domestic and foreign), bonds, precious metals, and commodities, and perhaps volatility instruments and real estate as other portfolio candidates. Then one has a very complex multi-asset allocation problem.

But the Kelly criterion in this simple two asset case does suggest that having just a few percent of a portfolio in Bitcoin is far from optimal given expected future performance based on its history. And a simple cash and Bitcoin approach alone can produce very desirable results.

Reference:

The Kelly Capital Growth and Investment Criterion, L.C. MacLean, E.O. Thorp, and W.T. Ziemba, editors. 2010, World Scientific Publishing (Chapters 3, 6, 7 by J.R. Kelly, E.O. Thorp, E.O. Thorp).