Three months to Bitcoin's Fourth Halving

So where are we now, post-ETF approvals?

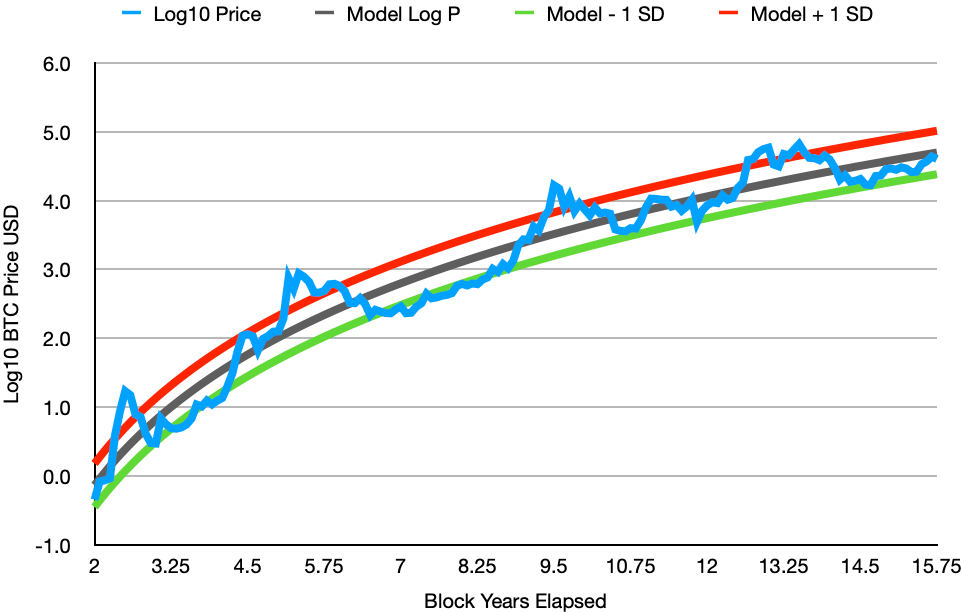

A Lindy technology adoption power law model best fit to Bitcoin’s long term price behavior (P ~ t^k) has an index of k = 5.4. Price rises faster than the 5th power of time. This is consistent with the early growth phase of an S-curve model (based on the Weibull cumulative distribution function). And the longer we remain in the early power law portion of the S-curve, the greater is Bitcoin’s ultimate wealth capture.

In these model regressions I use Block years because the Halvings and fortnightly difficulty adjustments that are of major importance happen on a Block calendar implicit in the Nakamoto consensus algorithm. Years have 52,500 blocks, epochs are 4 Block Years apart, and we are in the 4th epoch leading into the Fourth Halving at block number 840,000. The difference between Block years and Gregorian calendar years in length is currently small: the Block calendar has moved faster by about three weeks total over the four year epoch.

We have just passed 15.75 Block years, thus now we are three Block months (and calendar months) prior to that fourth halving due in April 2024. Here is a countdown clock:

https://www.bitkub.com/halving/

The 9 new Bitcoin spot ETFs that are actively trading, along with the GBTC conversion from a trust to spot ETF structure, were approved by the SEC on January 10th and started trading on January 11th of this year.

The first trading day the price shot up to $49,000 but slumped back to below $40,000 and is now $41,000 or so. This is typical buy on the rumor, sell on the news behavior. The price had risen from $27,400 just in the three months leading into the ETF approvals; it is still up about 50% since then.

It had become more and more apparent that SEC approvals for a number of funds were in the cards, since the SEC had lost a lawsuit initiated by Grayscale (GBTC sponsor) challenging the previous SEC denials for a Grayscale ETF. Grayscale won their lawsuit in a ruling in federal circuit court in August 2023 and the SEC announced in October that they had decided not to appeal that decision further.

Grayscale has wanted to convert GBTC to an ETF structure for several years, and had ownership of over 600,000 Bitcoin in their trust fund (with the same ticker symbol prior to the approval). They kept their fees relatively high when they converted to an ETF, dropping to 1.5% per year from 2%. Most of the new ETFs have annual fees of 0.3% or less.

Because now there are many less expensive alternatives to what had been with GBTC the “only game in town” for spot BTC traded on American stock exchanges, there has been net selling of GBTC offsetting around 60% of the flows into 9 new operating Bitcoin spot ETFs. Also a significant amount of Bitcoin from the unwinding of the FTX exchange business were sold during these first trading sessions.

In the first 11 trading days, the “New 9” accumulated 125,000 Bitcoin. There are less than 1.4 million Bitcoin to be minted. Ever. There are less than 2 million Bitcoin held by all exchanges, just 10% of the total current 19.6 million supply.

Once the FTX selling ends and net profit taking out of GBTC holdings abates, there could be major pressure on the Bitcoin price, whose emission rate will be cut to just 450 new coins a day with the forthcoming halving.

Figure 1. Regression of log10 price vs log10 time, in block years elapsed since Bitcoin’s first block. The black line fit is a power law of index k = 5.4. The red and green lines are +/- one standard deviation and represent oversold and overbought levels. Note that Bitcoin skews positive since it pokes above the plus one sigma line more than it falls below the minus one sigma line. The best fit model is $38,441 * (Block years / 15)^5.4.

At $41,000 Bitcoin is undervalued. The fair value at present according to the Lindy power law model is $50,020, and it is on track to rise to $75,000 a year after this next halving. That’s a potential 83% in the next 15 months. A fall to one sigma below trend at the 15 month-from-now mark would be around $36,000. That’s around $34,000 or more upside as opposed to around $5,000 downside for a 15-month holding, if the long-term behavior persists. Seems like good reward-to-risk.

Figure 2. This table from Fidelity (they have one of the new ETFs) shows 38 quarters of rolling 12-month returns. There are 24 asset categories covered. Bitcoin (bright orange box with a ฿ in the table) was the #1 asset category (“gold medalist”) in 24 of 38 quarters. It was in last place in 9 of the quarters. And the other 5 times it was either the “silver medal” winner or the next to worst! It was absolute best or next to best 2/3 of the time and absolute worst among these asset classes or next to worst 1/3 of the time. This is the best illustration I have ever seen of “the last shall be first”. Since first or second is twice as frequent as last or next to last, it’s a compelling opportunity. Size your positions appropriately, and for the long term.

Although I own other assets besides cash and Bitcoin, such as bonds for income, and some stocks, my general view is both return and volatility are concentrated in Bitcoin, so it might be rational to have a full or near to full Kelly allocation, appropriate to your timeframe for investment decisions ( “Kelly Criterion for Bitcoin”).

Bitcoin is highly volatile. This is not investment advice, neither is it advice for any particular Bitcoin ETF. Past performance does not guarantee future results. Bitcoin is best thought of as a long term savings vehicle. Your personal circumstances and timeframe should determine your allocation percentage.